Discover Asia's Luxury Resorts

Explore the finest resorts across Asia for an unforgettable getaway.

Tracking the Trail: The Hidden Stories Behind On-Chain Transaction Analysis

Uncover the secrets of on-chain transactions! Dive into the hidden stories that reveal the truth behind the data. Explore now!

Understanding On-Chain Transactions: A Beginner's Guide to Blockchain Analysis

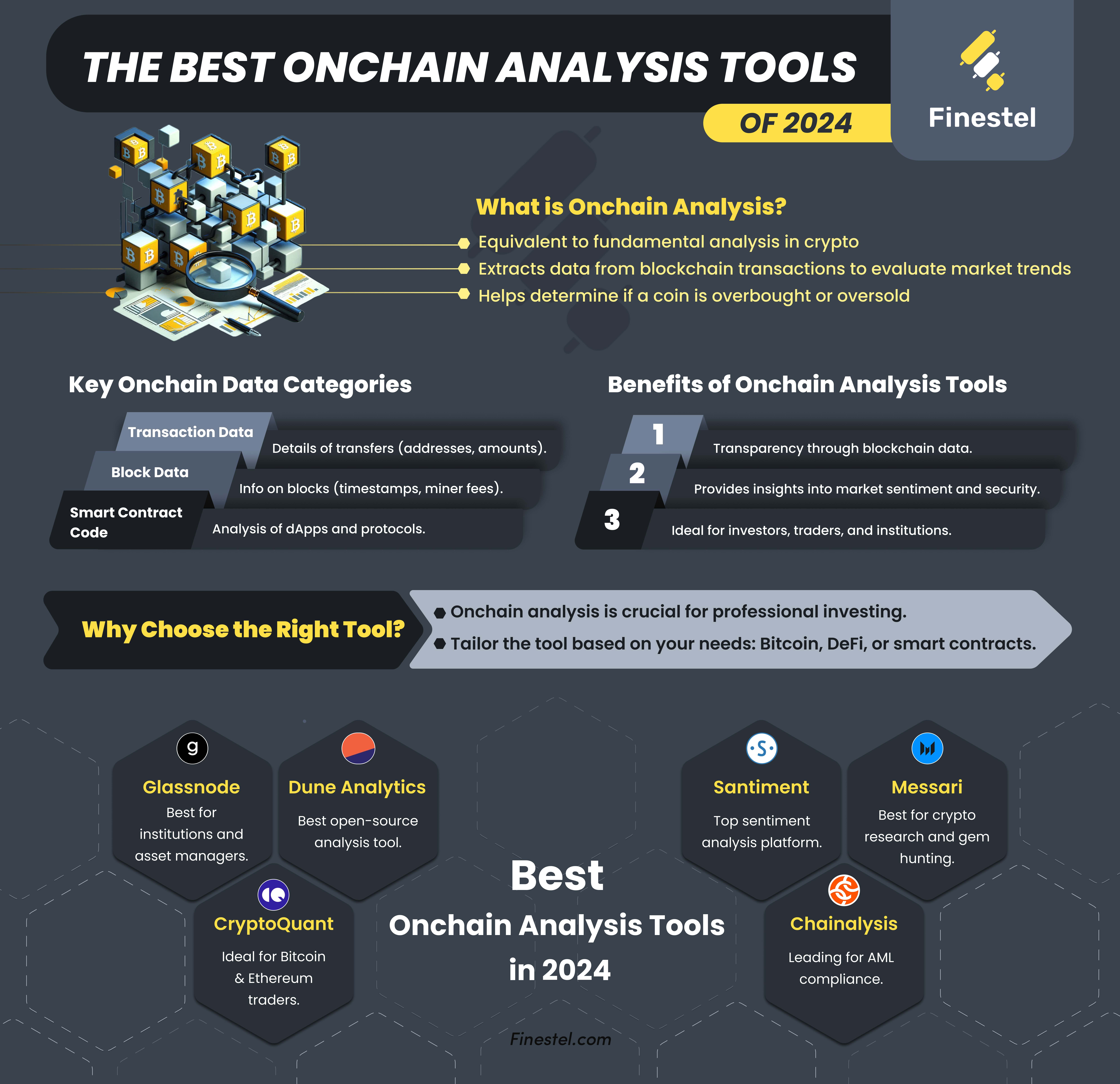

Understanding on-chain transactions is crucial for anyone looking to navigate the complex world of blockchain technology. At its core, an on-chain transaction occurs when data is recorded directly onto the blockchain, creating a permanent and immutable record of the transaction. This process involves the transfer of digital assets, such as cryptocurrencies, between participants on the network. To perform these transactions, users must have a digital wallet, which stores the cryptographic keys needed to send and receive assets. Blockchain analysis plays a key role in monitoring these transactions, allowing users to track activity and ensure the integrity of the network.

For beginners looking to delve into blockchain analysis, understanding the various components of on-chain transactions is essential. This includes familiarity with terms like transaction hashes, blocks, and smart contracts. To break it down further, here are some key elements to keep in mind:

- Transaction Hash: A unique identifier assigned to each transaction, enabling easy tracking.

- Nonce: A counter that ensures transactions are processed in the correct order.

- Gas Fees: Costs paid to miners for processing transactions on the network.

- Smart Contracts: Self-executing contracts with the terms directly written into code.

By familiarizing yourself with these concepts, you'll gain a better grasp of how on-chain transactions work and their implications within the blockchain ecosystem.

Counter-Strike is a highly popular tactical first-person shooter game that pits teams of terrorists against counter-terrorists. Players engage in intense multiplayer matches with a focus on strategy, teamwork, and skill. For those looking to enhance their gaming experience, they can find great offers with the bc.game promo code.

Uncovering the Truth: How On-Chain Transaction Analysis Reveals Financial Patterns

On-chain transaction analysis has emerged as a powerful tool for uncovering financial patterns hidden within the complex web of blockchain networks. By examining the immutably recorded transactions that take place on public ledgers, analysts can identify trends, track valuable assets, and even spot suspicious activities. This method not only provides insights into individual transaction flows but also reveals broader behavioral patterns among users, facilitating a deeper understanding of market dynamics.

For instance, tools that visualize transaction flows allow researchers to create transaction graphs which can highlight connections and correlations between various wallets. Such visualizations make it easier to pinpoint money laundering activities or sudden surges in trading volumes. As financial institutions and regulators increasingly acknowledge the importance of an on-chain analysis, the potential to mitigate risks and harness opportunities in the cryptocurrency realm becomes not only apparent but essential.

What Can On-Chain Transaction Data Tell Us About Market Trends?

On-chain transaction data serves as a powerful analytical tool for understanding market trends in the cryptocurrency space. By examining transaction volumes, wallet activity, and timed transactions, analysts can gauge investor sentiment and anticipate market movements. For example, a sudden spike in transaction volume may indicate a growing interest in a particular asset, while increased wallet activity often suggests accumulating positions by long-term holders. Furthermore, analyzing the time of day when transactions peak can reveal optimal trading hours and enhance trading strategies.

Moreover, on-chain data allows for a deeper understanding of the market dynamics, as it provides insights into the behavior of both retail and institutional investors. By categorizing transaction types—such as those from exchanges, personal wallets, or smart contracts—analysts can paint a clearer picture of the forces driving price changes. Using tools like moving averages and other statistical models, it’s possible to identify patterns that may precede significant market shifts, giving traders and investors a competitive edge in a rapidly evolving landscape.