Discover Asia's Luxury Resorts

Explore the finest resorts across Asia for an unforgettable getaway.

Get Insured and Save: The Discounts You Didn't Know Existed

Unlock hidden discounts on insurance and start saving today! Discover how to maximize your coverage without breaking the bank.

10 Hidden Insurance Discounts You Might Be Missing Out On

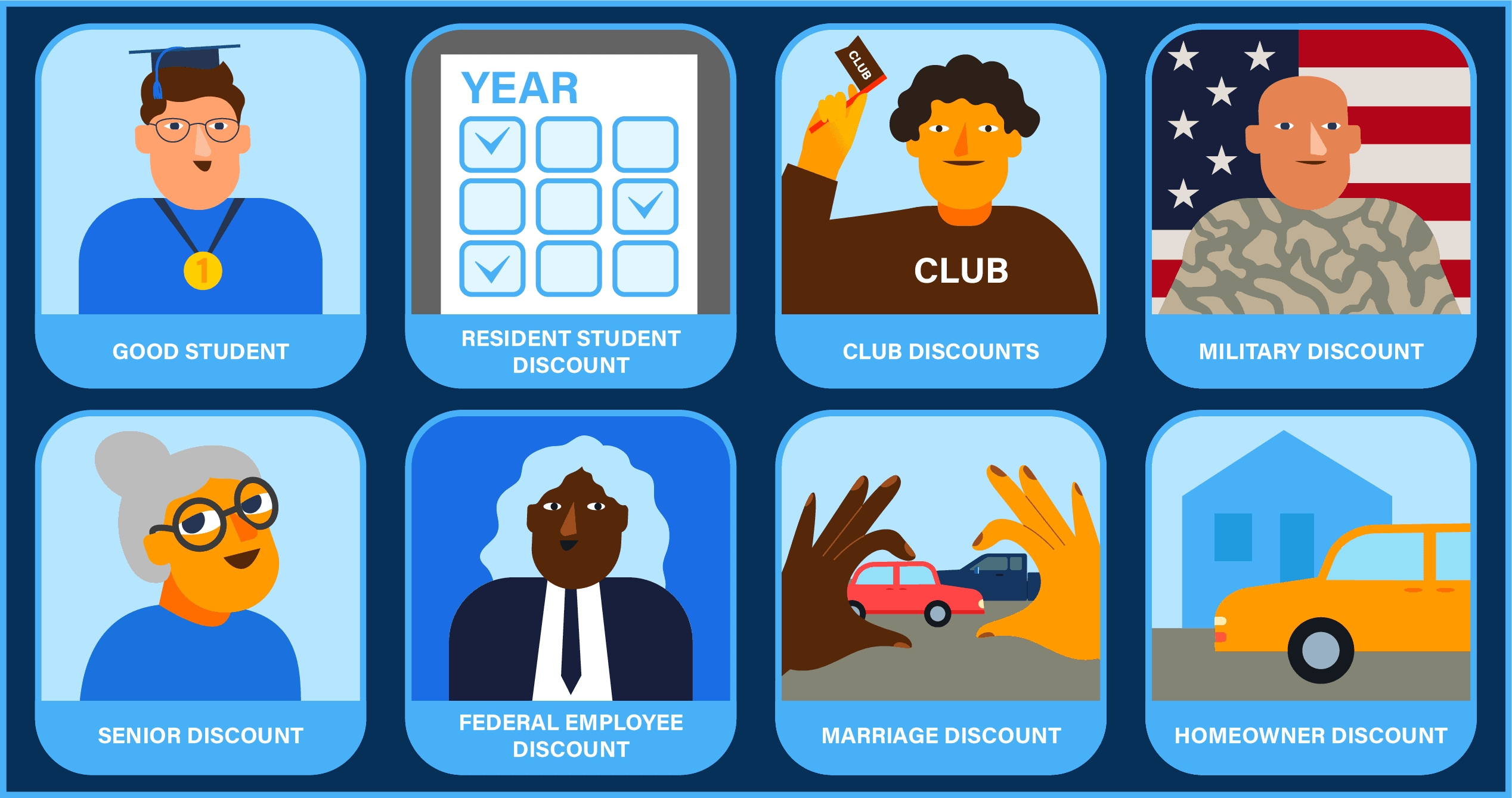

When it comes to saving money on your insurance premiums, many people are unaware of the multitude of discounts available to them. From bundling policies to maintaining a good credit score, understanding these hidden insurance discounts can significantly reduce your overall costs. For example, did you know that many insurers offer discounts for completing specific defensive driving courses? This not only makes you a safer driver but also rewards you with lower rates. Additionally, if you're a member of certain professional organizations or alumni groups, you might qualify for exclusive policy discounts.

Another often-overlooked area for insurance discounts is your home security measures. Installing security systems, smoke detectors, and even smart home technology can lead to substantial savings on your homeowner's insurance. Moreover, don't forget to inquire about discounts for low mileage on your vehicle or for being claims-free for several years. Remember to periodically review your policy and ask your insurance agent about any potential discounts you may have missed, as these can change frequently. By staying informed, you can ensure you're not leaving money on the table.

How to Maximize Your Savings: A Guide to Insurance Discounts

When it comes to saving on your insurance premiums, understanding the various insurance discounts available can make a significant difference. One of the most effective strategies is to regularly review and update your insurance policies. Many companies offer discounts for bundling multiple policies, such as home and auto insurance, which can save you up to 25%. Additionally, inquire about discounts for safe driving records, low mileage, and even being a member of certain organizations. Taking proactive steps to assess your coverage can ensure you’re not leaving money on the table.

Another way to maximize your savings is by considering your risk factors and making adjustments accordingly. For instance, increasing your deductibles can lower your premium, and installing safety devices in your home or car can lead to insurance discounts as well. Don’t forget to ask your insurer about seasonal promotions or loyalty rewards that may apply to you. Staying informed and actively engaging with your insurance provider allows you to take advantage of various savings opportunities while ensuring you maintain the right coverage for your needs.

Are You Eligible for These Uncommon Insurance Savings?

Insurance savings are often overlooked, and understanding your eligibility for these uncommon insurance savings can lead to substantial financial relief. Many policyholders are unaware that certain lifestyle changes, such as adopting a healthier lifestyle or improving home security, can qualify them for discounts. Additionally, loyalty programs offered by insurance providers may reward long-term customers with significant reductions in their premiums. It's important to review your policy regularly and communicate with your agent about any changes that could qualify you for these savings.

Furthermore, niche discounts may apply based on unique factors that some are simply unaware of. For example, if you work in specific professions, like teaching or public service, you might be eligible for reduced rates on auto and homeowners insurance. Additionally, bundles for multiple policies, such as combining auto and home insurance, can lead to increased savings. Always feel free to ask your insurance provider about any lesser-known discounts, as being proactive could unlock uncommon insurance savings that could significantly impact your budget.