Discover Asia's Luxury Resorts

Explore the finest resorts across Asia for an unforgettable getaway.

Phantom Discounts: Are You Missing Out on Hidden Auto Insurance Savings?

Uncover hidden savings on auto insurance! Discover if you're missing out on phantom discounts that could save you big bucks.

Top 5 Hidden Discounts in Auto Insurance You Didn't Know About

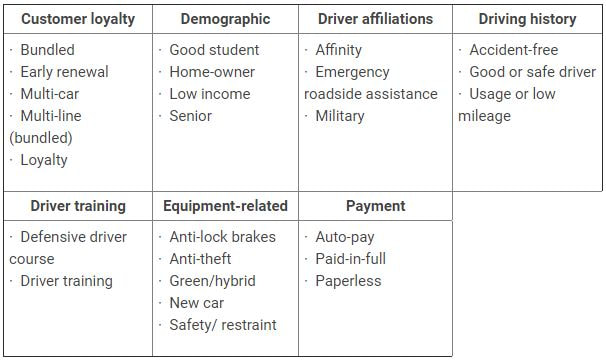

When shopping for auto insurance, many consumers overlook potential discounts that can significantly reduce their premiums. Here are the Top 5 Hidden Discounts in auto insurance that you might not be aware of:

- Safe Driver Discount: If you have a clean driving record, many insurers offer a discount for safe driving. This can often be checked with your insurance provider.

- Bundling Discounts: Consider bundling your auto insurance with homeowners or renters insurance. This can lead to substantial savings; check with companies like State Farm for their offers.

- Low Mileage Discount: If you drive less than the average number of miles per year, you may qualify for a low mileage discount. Insurers like GEICO often provide this incentive.

- Paperless Discount: Opting for electronic statements can sometimes earn you a paperless discount, so ask your insurer about this option.

- Education Discounts: Some companies offer discounts for drivers who have completed a defensive driving course. Be sure to inquire with your Progressive agent if this applies to you.

Are You Overpaying? Discovering Untapped Savings in Your Auto Insurance Policy

Many drivers are unaware that their auto insurance policies may not be offering the best coverage at the most competitive rates. By regularly reviewing your policy and comparing it with other options in the market, you could uncover significant savings. For instance, did you know that shopping around for auto insurance can lead to rates that are hundreds of dollars lower each year? Additionally, consider examining any discounts you might qualify for, such as those for safe driving, low mileage, or bundling with other insurance types. These untapped savings can add up quickly, providing you with a solid reason to reassess your current premiums.

Furthermore, assessing your coverage limits and deductibles can also reveal opportunities for savings. If you find yourself over-insured for certain aspects, you might be paying more than necessary. For a comprehensive understanding of what coverage is essential, Consumer Reports provides valuable insights on how to minimize unnecessary costs while ensuring adequate protection. A simple adjustment to your policy can lead to better savings and a more suitable plan tailored to your specific needs. Don't let your auto insurance be an afterthought; investigate whether you could be overpaying and tap into those potential savings today.

What Questions Should You Ask to Uncover Hidden Auto Insurance Discounts?

When exploring hidden auto insurance discounts, it's essential to ask your agent or provider specific questions that can reveal potential savings. Begin by inquiring about multi-policy discounts which can apply if you bundle your auto insurance with homeowners or renters insurance. Additionally, ask about low mileage discounts; if you drive fewer miles than the average, you may qualify for reduced rates. Another valuable question is whether your insurer offers discounts for completing a defensive driving course, which not only enhances your skills but also reflects positively on your premiums. For further understanding, check reputable resources like Consumer Financial Protection Bureau.

Furthermore, don't overlook the significance of reviewing your car's safety features and asking if they can qualify you for any discounts. Features like anti-theft devices, advanced safety systems, and even having a good student driver in the household can often lead to lower premiums. Lastly, inquire about any other age-related discounts for younger or senior drivers. The more questions you ask, the better your chances of uncovering hidden discounts that can lead to significant cost savings. For additional tips, visit NerdWallet.